Daniel Karehana of Ngāiterangi, Ngāti Ranginui, Ngāti Awa and Ngāti Pāoa, is CEO and founder of BlinkPay.

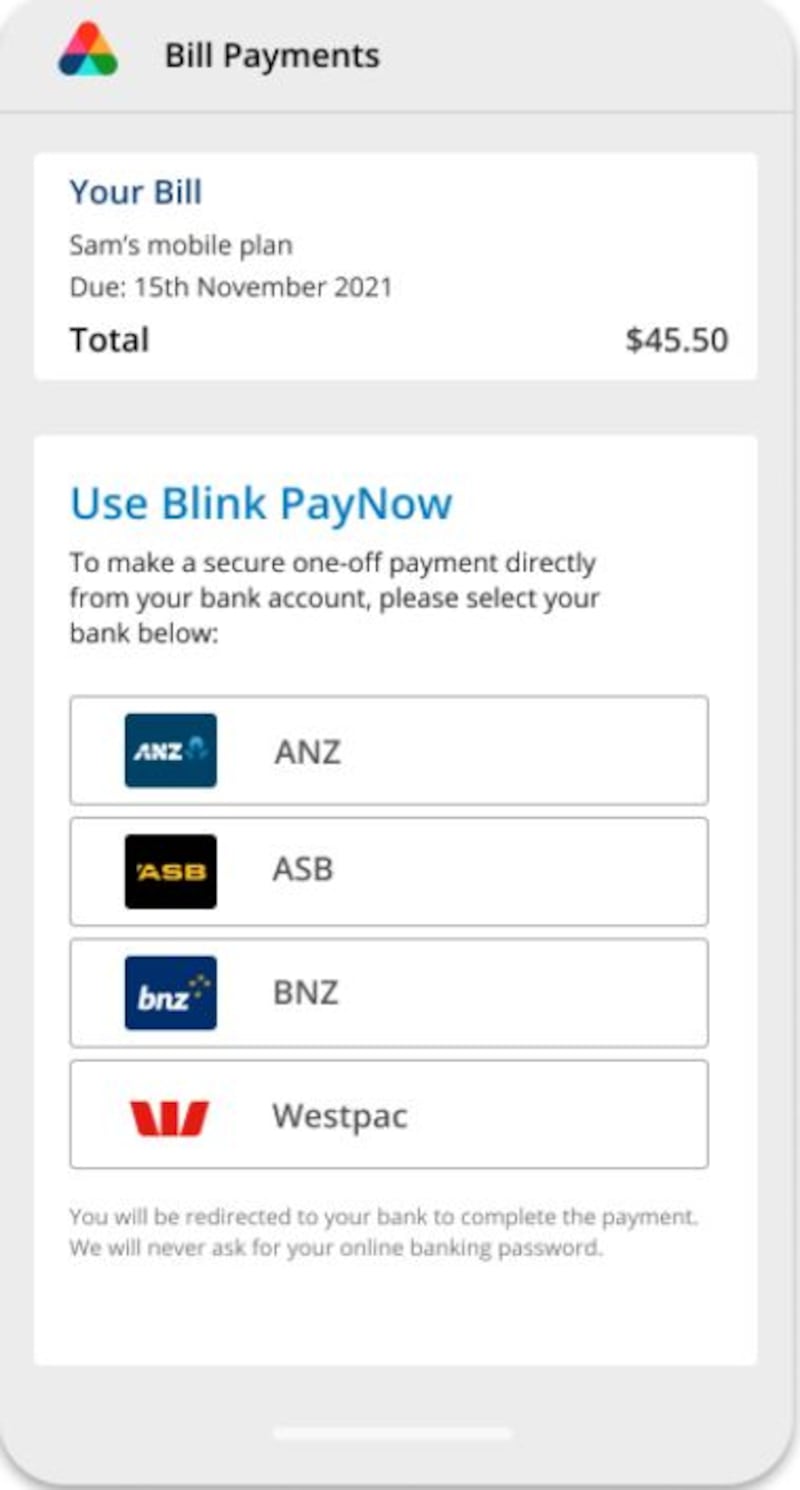

Blink Pay is designed to be able to pay all your bills from one single application.

Karehana says he became hōhā (annoyed) at work one day while working as a Chartered Accountant, trying to log into different websites to find the right amounts to pay for his electricity, telephone, and internet, among other things, while also knowing that the rates bill is received as a paper bill that he had left on his refrigerator.

“I threw my hands up and thought ‘there’s got to be a better way!!’. That’s when I realised it would be a whole lot easier if all of these different systems talked to each other.”

“It's easy to forget passwords if you use these websites infrequently or find the emails they send you,” he says.

According to Karehana, their first product, 'Blink Bills,' is aimed to achieve just that by integrating your bills into your online banking app, allowing you to receive, manage, and pay them all from one convenient location.

“I had this brainwave back in 2016 and have been on the path to establishing BlinkPay (which now includes data and payment services) ever since.”

BlinkPay is also registered with the Amotai network, Aotearoa's supplier diversity intermediary tasked with connecting Māori and Pasifika-owned businesses with buyers seeking goods, services, and works.

Through the Māori Business Growth Fund, Te Puni Kōkiri has supported BlinkPay with the development builds of their ‘Blink Bills’ and ‘Blink Debit’ products over the past three years.

The fund provides specialist support to Māori businesses to help them achieve their growth aspirations.

The data revolution and what does that mean for Māori

The data revolution, according to Karehana, is happening all over the world, and it will start in Aotearoa this year when the NZ government introduces the Consumer Data Right (CDR) legislation.

According to Karehana, Europe's General Data Protection Regulation (GDPR) was first enacted in 2018 to provide citizens the right to secure their personal data.

“This was a response by governments to the rapid rise and use of personal data on the internet by companies like Facebook and Google. A host of other countries have followed suit and notably, Australia introduced its CDR in 2019.”

Companies must obtain your consent (which you can revoke at any time), according to Karehana, if they intend to store or use your data in any way. While this safeguards customer data, it also allows you to share it with businesses for a variety of new data-driven services.

Karehana also mentions that the banking industry is a hot topic right now because it's one of the first industries in which governments have adopted legislation forcing companies to share data with other parties (if you consent). For instance, you might share your banking data with a personal budgeting tool to better manage your finances, or you may give it to a financial advisor.

“For Maori, I think the benefits are two-fold. Firstly our data will be protected under CDR which is important when we see big tech companies from overseas mining personal data as we speak and our data as a people is unique.”

Secondly and more importantly, according to Karehana, iwi organisations may want to offer targeted budgeting, finance, or insurance services to their iwi members and they can do this if those iwi members consent to sharing their personal data with their own iwi organisation.

“CDR will also expand to include other sectors such as telco and energy as an example and these are all areas where our people's data can be used to provide targeted assistance.”

BlinkPay awarded top security certification

Receiving a security certification, which implies they've been examined and accredited to international standards for information security management (ISO 27001), is a big thing for a fintech (financial technology) startup-like BlinkPay, according to Karehana.

“It’s a worldwide gold standard if you like … it took close to a years’ worth of work to meet the requirements.”

“It says to other organisations that we are properly equipped to receive and manage data securely and means when we partner with banks for instance, they know their data will be secure with us.”

Inspiration

Karehana says that after graduating from high school in Tauranga, he moved to Auckland to pursue a Bachelor of Māori Studies majoring in Economic Development at AUT. It was here while working on a research project on the Māori Development Corporation and speaking with people like Tiwana Tibble, the MDC's CFO, June Jackson, from the Manukau Urban Māori Authority and John Tamihere, who had recently taken over Te Whānau o Waipareira, that drove him to seek a career in Finance.

“It was an area that they identified as having very few of our people in. I spent close to 16 years working in banking, insurance, and investments as a result but I always remembered those pioneering leaders.”

Karehana also gives thanks to his whānau, particularly his grandmother Mihi Gardiner, who is close to 90 years old and still has a razor-sharp mind and doesn't appear to have aged a day.

“She’s always been proud of my achievements and I am so lucky to have her.’

“I think my move into fintech has left everyone scratching their heads … I’m sure they will come across our products in their day-to-day lives and will be able to connect the dots “Oh that’s what the cuzzie has been going on about for the last five years!

Future plans

According to Karehana, this year will be a big year after signing their first major banking contract with BNZ last year and expecting to sign more contracts with other major banks soon, allowing customers of those banks to receive bills, make online payments, and use other data-driven services all through the BlinkPay platform.

Karehana also claims that he is applying for CDR in Australia in order to expand his product line.

“BlinkPays goal is to provide better customer experiences when they interact with Banking and other financial services. If we do that well enough, my long-term dream would be to help establish a Maori Bank one day.”

For more information about BlinkPay click here.